washington state capital gains tax vote

Capital gains tax passes House heads to Senate for concurrence Michael Goldberg April 22 2021 After several hours of debate the House passed the Senates capital gains tax bill Wednesday in a 52-46 vote bringing Democrats one step closer to rebalancing Washingtons tax code. Washingtons advisory votes are.

Live Midterm Election Results 2018

Exceptions include the sale of real estate livestock and small family-owned businesses.

. Advisory Vote 37 is. Engrossed Substitute Senate Bill 5096 sponsored by Sen. The next steps on whether Washington will remain income tax free will be in the courts as the I-1929 ballot campaign to repeal the capital gains income tax has suspended its activities.

By contrast the capital gains tax proposed by Gov. That tax is intended to help fund. Voters in Washington state will get their chance to weigh in Tuesday at least symbolically on the controversial new capital gains income tax set to go into effect on Jan.

An advisory vote on Washington states new capital gains tax on high-profit assets was failing after an initial round of election results were released Nov. Sponsored by Democratic Sen. Washington Voters to Weigh in on New Capital Gains Income Tax October 25 2021 Jared Walczak On May 4th Gov.

OLYMPIA Earlier today the Washington State Legislature approved a critical piece of tax reform legislation. Senate Passes Capital Gains Tax On Saturday the Senate narrowly passed legislation by a vote of 25-24 to establish a capital gains tax. On November 2nd Washington lawmakers will learn what voters think about it.

Jay Inslee D signed legislation creating a 7 percent capital gains tax to take effect next year. OLYMPIA Washington voters were rejecting a state advisory measure to adopt a new 7 tax on capital gains above 250000 in Tuesday nights election results. June Robinson D-Everett enacts a capital gains excise tax to fund the expansion and affordability of child care early learning and the states paramount duty to provide an education for the children of Washington.

The Washington state Senate is expected to debate and vote on a bill Saturday to establish a new capital gains tax. Bill sponsors say fewer. The legislation placed a 7 tax on the sale of stocks bonds and other assets above 250000.

They are nonbinding meaning they do not change the law. Senate Bill 5096 sponsored by Sen. 37 The legislature imposed without a vote of the people a 7 tax on capital gains in excess of 250000 with exceptions costing 5736000000 in its first ten years for government spending.

Last year a statewide capital gains tax Senate Bill 5096 was approved by the Legislature and signed into law by Gov. The measure approved by the Washington Legislature last year imposed a 7 tax on the sale of stocks bonds and other high-end assets in excess. Approved by the Legislature on Sunday Senate Bill 5096 will put a new 7 tax on capital gains of more than 250000 from the sale of stocks and other investments.

The Washington state Legislature imposed the tax without voter approval earlier this year. A new effort seeking to repeal Washingtons capital gains tax has surfaced with tens of thousands of dollars of PAC money in tow. June Robinson D-Everett would establish a capital gains tax of 7 percent on capital gains that exceed 250000 in a given year.

Advisory votes allow voters to weigh in on taxes passed by the Legislature. An advisory vote on Washington states new capital gains tax on high-profit assets was failing after an initial round of election results released on Nov. The Attorney General is asking the state Supreme Court.

Jay Inslee signed the tax into law in May 2021. July 13 2022 The Washington State Supreme Court today expedited the ultimate resolution of the Freedom Foundations lawsuit challenging the capital gains income tax bill passed by the Legislature in 2021 by announcing it will accept direct review of the case effectively allowing the matter to bypass the court of appeals. State Measures Advisory Vote No.

The Washington Repeal Capital Gains Tax Initiative is not on the ballot in Washington as an Initiative to the People a type of initiated state statute on November 8 2022. The bill now heads back to the Senate for final concurrence. Voters in Washington state will get their chance to weigh in Tuesday at least symbolically on the controversial new capital gains income tax set to go into effect on Jan.

This initiative would have repealed a 7 capital gains tax that was set to begin being collected in 2023. Jay Inslee in December is estimated to raise 875 million per year at a rate of 9 on stocks bonds and commercial real estate. ___ Repealed ___ Maintained.

June Robinson SB 5096 originally would have been a 9 tax on gains from the sale of things such as stocks bonds and other assets above 25000 for individuals and. Earlier this year an Inslee-appointed judge ruled that the capital gains income tax is unconstitutional. A date for oral arguments has not yet been set.

This tax increase should be.

Today Marks The Last Day For Filing Annual Income Tax Returns Fbr Income Tax Tax Return Income Tax Return

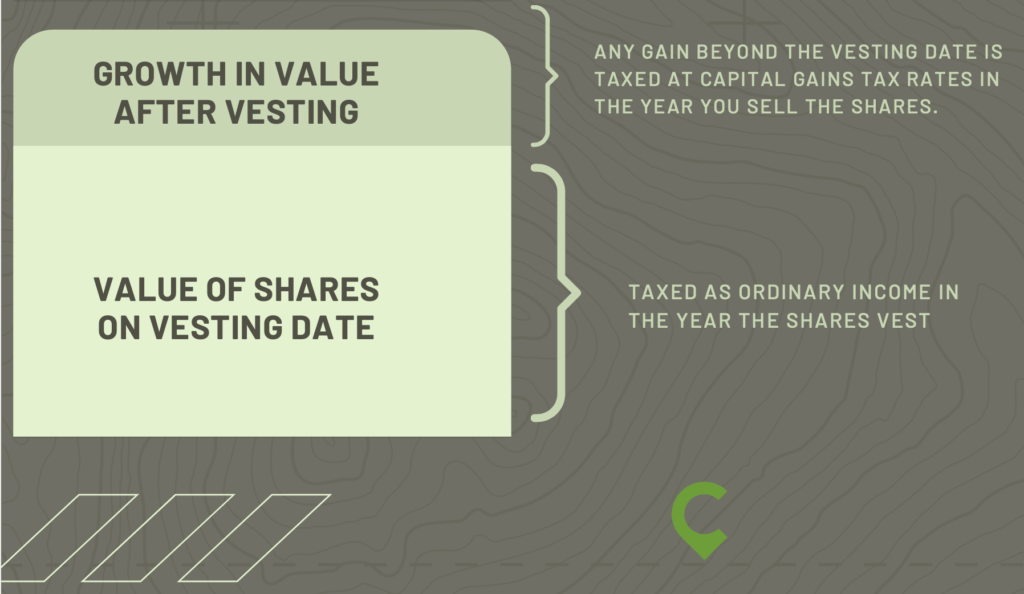

Rsu Taxes Explained 4 Tax Strategies For 2022

2022 Corporate Tax Rates In Europe Tax Foundation

The Democratic Push To Tax The Rich More Is 40 Years In The Making Npr

Seattle Moves Forward On 12b Light Rail Project In 2022 Light Rail Seattle History Seattle

A2z Valuers Offers Valuation Services In Field Of Capital Gain Valuation Every Body Can Get His Profit With That Https Goo Gl Vqt Bell The Cat Job Creation

Ballet Flats Are Back Baby Here S How To Wear Them In 2020 Ballet Flats How To Wear Leather Ballet Flats

Rsu Taxes Explained 4 Tax Strategies For 2022

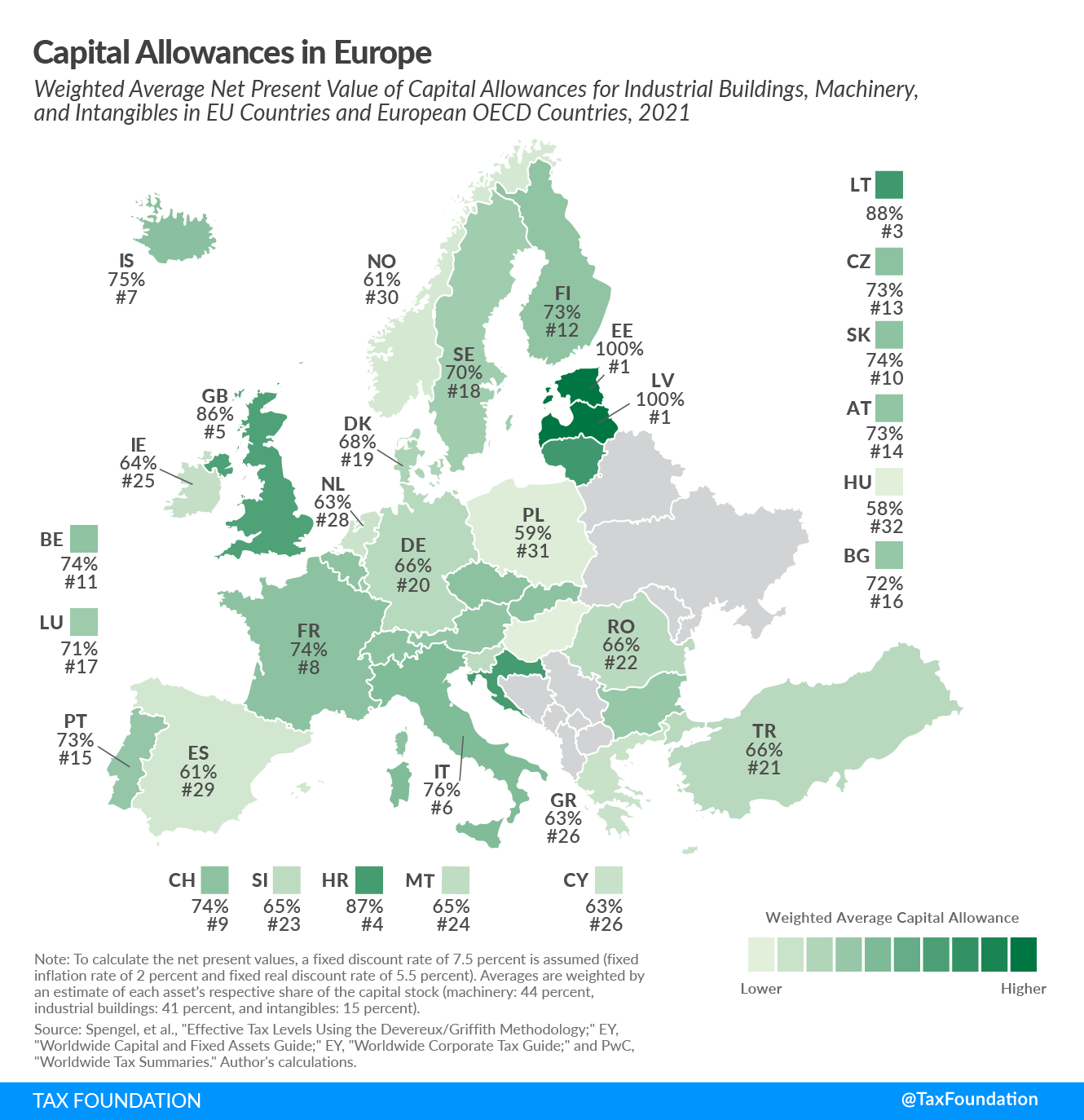

Capital Allowances Capital Cost Recovery Across The Oecd

Capital Allowances Capital Cost Recovery Across The Oecd

Capital Allowances Capital Cost Recovery Across The Oecd

The Impact Of Tax Hikes On Stocks Nasdaq

The Democratic Push To Tax The Rich More Is 40 Years In The Making Npr

The Democratic Push To Tax The Rich More Is 40 Years In The Making Npr

Rsu Taxes Explained 4 Tax Strategies For 2022